To write off a bad debt, you process a credit journal for the debtor in the Distribution system. When the credit journal is posted, the debtor's outstanding account balance reduces and the journal amount is written to the GL account for Bad Debts.

To process a credit journal:

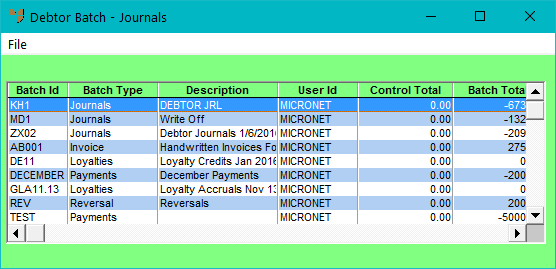

Micronet displays the Debtors Journals screen.

|

|

|

Warning Your selection at Post GST Adjustment determines whether a transaction should be updated to the GST file. If adjusting for an EXPORT sale customer, select Yes. The transaction is reportable even though the GST is zero and should appear in the GST Free column of the GST Report - GST Payable in the General Ledger. |

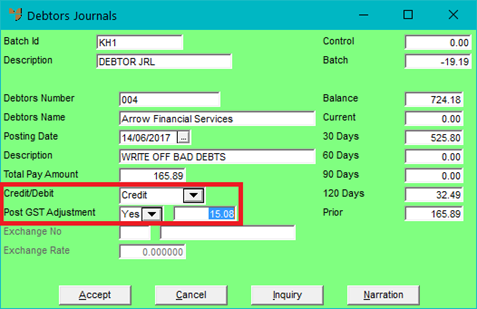

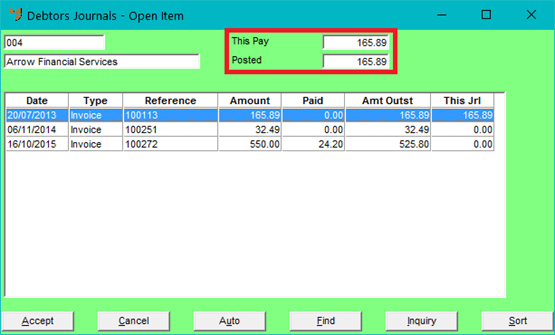

For Open Item debtors, Micronet displays the Debtors Journals - Open Item screen.

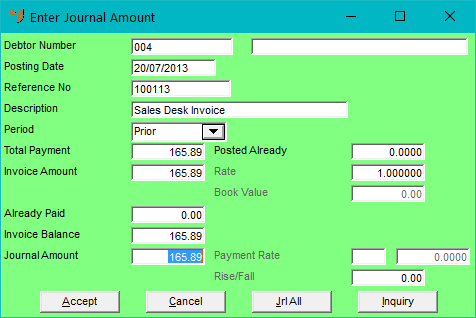

Micronet displays the Enter Journal Amount screen.

Micronet redisplays the Debtors Journals - Open Item screen and updates the Posted field.

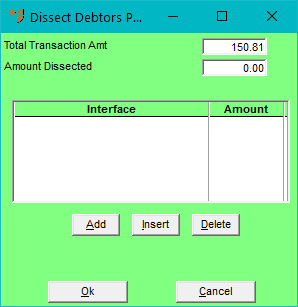

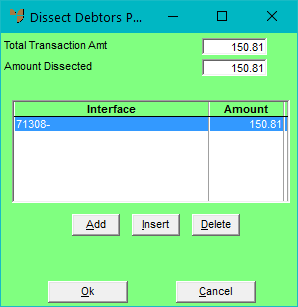

Micronet displays the Dissect Debtors Posting screen.

|

|

|

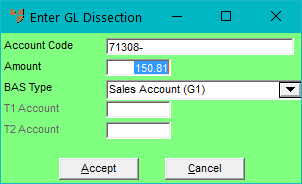

Warning If you selected Yes at Post GST Adjustment on the Debtors Journals screen and confirmed a GST amount, the BAS Flag MUST be set to Sales (G1) to comply with BAS Rule 1. If you selected Yes at Post GST Adjustment and confirmed a GST amount of zero for an export sales customer, the BAS Flag MUST be set to Sales To Exports (G2). If you selected No at Post GST Adjustment, the BAS Flag MUST be set to No BAS as you have determined the adjustment or journal is not reportable and should not update to the GST file. |

Micronet immediately updates the debtors account balance and writes the amount to the Bad Debts account. It then redisplays the Debtors Journals screen where you can enter another journal into the batch if required.